Moving Average indicator (MA) is one of the most common indicators used in forex trading. This indicator is easy to set up and easy to interpret.

Speaking simply, the Moving Average measures only the moving average price over a period of time. It smooths out the price data, allowing to see market trends.

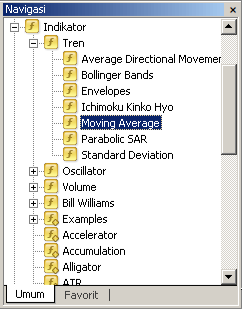

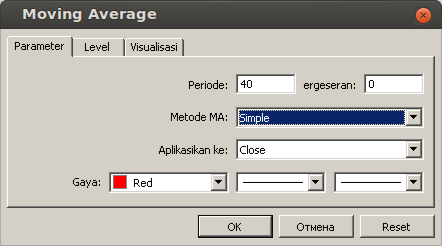

How to Implement Moving Average Indicator

The use of this simple method implies a reduction of the loss and increase in income. Moving averages have their incorporated in these instruments, as they are used in trading in the foreign exchange market by most traders to eliminate harassment and to find entry and exit points from the market.

The moving average shows the average price of a currency pair over a given period of time. In calculating MA, a mathematical calculation is performed for the average price of a currency in a given period. After a price change, the average value can also change either down or up.

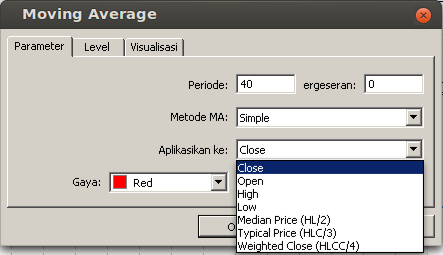

The MA on the chart shows the average price of a particular currency pair for the previous period, which smoothed a price graph. By using a higher period number, which is the average value calculated for that period, the corresponding graph will be more refined. Moving Average curves are usually formed based on the closing price of the currency, although they can also be calculated based on the average “High”, “Open” and “Low“.

If the price moves flat and its range is close to the moving average, it is not recommended to open a new position.

In a shorter period, the MA reacts more quickly to price changes in a currency pair, but at the same time, it is not enough to filter out “disruptions”. For a longer period, the moving average will neutralize the impact of the disturbance, but its reaction to changing trends will be delayed.

How to use Moving Average Indicator

Moving Average is a trend indicator. In addition to the obviously simple function a Moving Average has more to illustrate:

Moving Average is used to determine:

- Price direction – up, down or sideways.

- Location Price – bias trading: above Moving Average – buy , under Moving Average – sell .

- Price Momentum – Angel Moving Average: rising angle – momentum holds, falling angle – momentum pauses or stops.

- Support / resistance level.

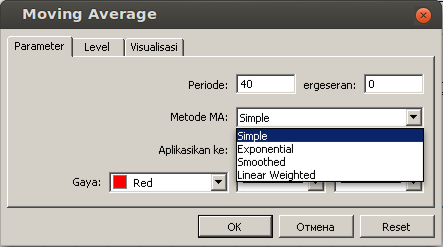

Types of Moving Averages Indicator

- SMA – Simple Moving Average – shows the average price for a certain time period.

- EMA – Exponential Moving Average – gives priority to the most recent data, thus reacting to price changes faster than the Simple Moving Average.

- WMA – Weighted Moving Average – places emphasis on most recent data lacking – on older data.

The most common Moving Average indicator setting used in Forex (Forex)

- 200 period EMA and 200 period SMA

- 100 period SMA

- 50 period SMA

- 34 period SMA

- 20 period EMA and 20period SMA

- 10 period EMA and 10 period SMA

Try and test and then choose your favorite Moving Averages set.