ADL Quick Summary

Advance Decline Line Indicator involves the following signals:

Advance Decline Line Indicator is rising and so does the price — uptrend is healthy.

ADL is falling and so does the price — downtrend is healthy.

Divergence between ADL and price – changes/pauses in the trend should be expected.

Advance Decline Line indicator

Advance Decline Line indicator is used in Forex to identify and confirm strength of a trend, as well as its chances for reversing. ADL indicator in Forex provides a comparison between the number of market advancing and declining moments for a given period of time.

Advance Decline Line Formula

ADL = (N of Advancing Issues — N of Declining Issues) + Previous Period’s ADL Value

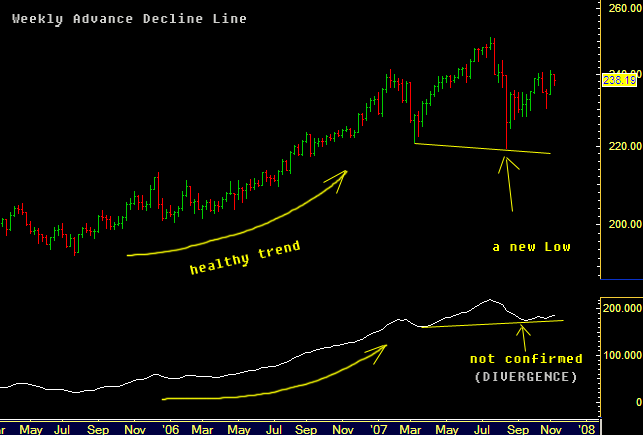

Advance Decline Line chart example

The Advance Decline Line is found by measuring the difference between advancing and declining issues for each day. This value (+ or – ) is added to the previous ADL value.

How to trade with Advance Decline Line

In general, if the market is trading upwards and Advance Decline Line is sloping down (divergence), it suggests that a current trend is losing its strength and may soon reverse. If the market is trending upwards and so does Advanced Decline Line, the situation is stable and the current trend is said to be strong.

A divergence that can be seen between price and indicator line is only a warning of possible changes settling. A divergence factor for ADL indicator may last for a long period of time, therefore ADL indicator cannot be used as a timing indicator.

Daily ADL is usually used to determine strength and length of short term intra day trends in Forex, while weekly ADL is found to be more useful for trend comparisons over several years.